We are committed to providing every possible solution that is required for our customers and that is where we have a very strong product management group which focuses on the current and future needs of our customers. The solution has been built after an extensive study over a period of 3 years by specialists in Actuary, Finance, CPA and Chartered Accountancy with the purpose of providing the insurance companies with an innovative software that will redefine their current processes and ensure smooth implementation of the regulatory reporting requirements especially in regards to IFRS 17.

With our IFRS 17 Solution, we will offer you a completely Transformative and fully automated IFRS Actuarial Accounting (Sub-ledger modules), IFRS 17 Actuarial Cash Flow Modelling including FCF (for Life & Non-Life Contracts) and Reporting / Disclosure modules for better Financial Control and Reporting.

Our IFRS 17 solution is intended to provide our customers with an interactive and Customizable Analytical Dashboard, where reports can be easily accessed and generated for different departments.

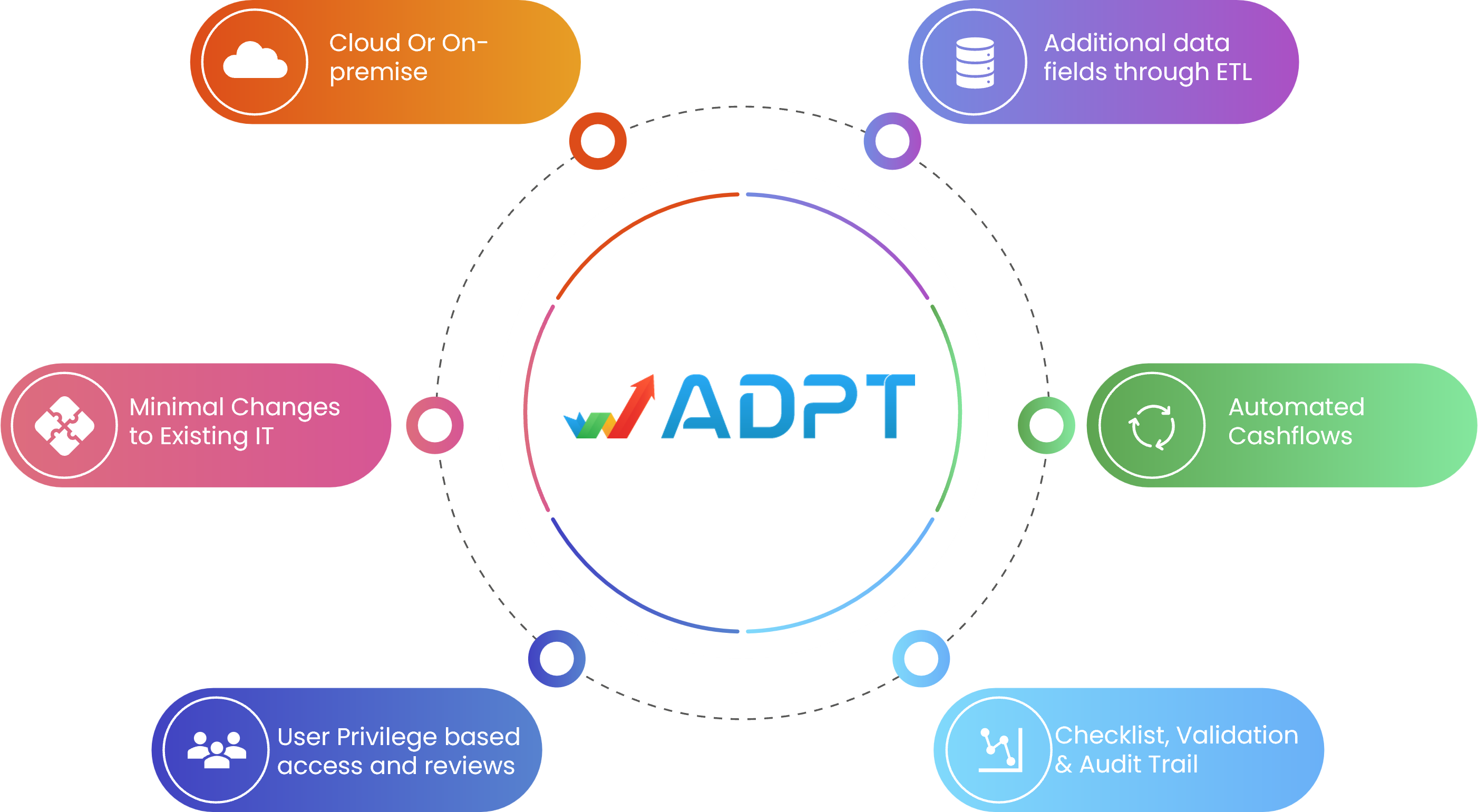

The capability of our solution in providing comparative reports will ensure compliance with the local regulations as well as demonstrate the impact of adopting IFRS 17, thereby enabling our clients in parallel journey as required by the regulators Moreover, with our solution, insurance companies have the provision of a unique feature that presents a comparative view of IFRS 4 and IFRS 17 starting from comparable SOFP, SOPL to comparable Disclosure Reports that provides insurance companies a competitive edge in the market vis-à-vis its peers ADPT is bundled with comprehensive features which are simple, easy to operate, perform the actuarial calculations and quick to extract charts and reports. The key features of the product includes